ทำไมต้องเชลล์ฟลีทโซลูชั่น?

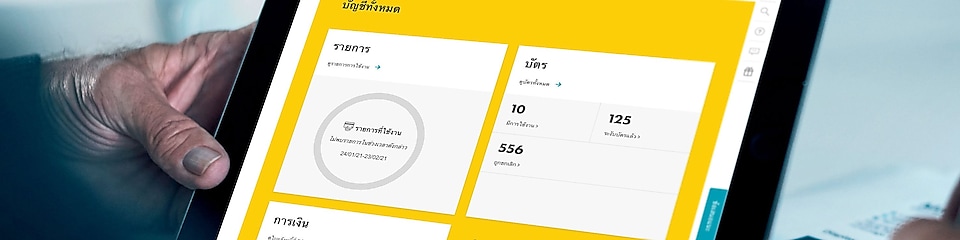

ประหยัดยิ่งกว่า มั่นใจยิ่งกว่า พร้อมเพิ่มประสิทธิภาพให้กับธุรกิจของคุณ ด้วยรายงานข้อมูลที่ช่วยให้การวิเคราะห์ และควบคุมค่าใช้จ่ายน้ำมันด้วยวงเงินที่เหมาะสมเป็นไปอย่างง่ายดาย ช่วยปรับปรุงระบบเงินหมุนเวียนของคุณ และยังควบคุมการทุจริตจากการเติมน้ำมันได้อีกด้วย